FX Risk Management

Manage the impact of foreign currency exposures with optimized hedging programs and costs. FX volatility and economic conditions call for more focus on advanced analytics to drive the right hedging decisions to minimize impacts to earnings and the right accounting treatment. Learn how your organization can identify exposures, make informed decisions and optimize your exposure and hedge management.

REQUEST A DEMO

End-to-end Risk Management & Compliance

Control FX Headwinds & Tailwinds

Improve the effectiveness of hedging and identify opportunities to organically reduce net exposure

Exposure Analysis & Management

Analysis of currency impacts to protect balance sheets and income statements from currency volatility.

Trade Management

A single-source record of FX spot, forward, swap, and option trades, enabling two-way integration with trading portals for a complete FX workflow.

Valuation and Accounting

Derivative and hedge accounting for ASC and IFRS compliance including mark-to-market for valuations and additional VaR calculations.

Business Intelligence

Interactive dashboards for comprehensive data visualization and business intelligence, enabling treasury teams to quickly illustrate overall FX exposure and risk.

Learn why the world’s leading businesses choose Kyriba to manage their financial risk management, exposure aggregation, FX hedging programs, trading, and accounting requirements.

- Identify, aggregate and reduce net exposures from disparate systems

- Improve the effectiveness and costs of your hedging program

- Realize a single source of record for your FX trading activities

- Automate the mark to market and accounting entries

Submit the form to discuss your needs and questions with one of our experts.

Fill out the form and we will be in touch with you shortly

The Value of Activating Enterprise Liquidity

After years of global economic expansion, many experts are forecasting uncertain times ahead. With Kyriba, treasury and finance leaders are in an advantageous position. They can see everything when it comes to their global cash, liquidity and risk exposures; and they can execute their strategies more easily and efficiently.

100%

Visibility into global cash and liquidity

80%

Increase in global productivity via cloud automation

$0.01

Reduce impact of currency volatility on EPS

50%

Average reduction in idle cash

70%

Increase in ability to work with other teams on strategic initiatives

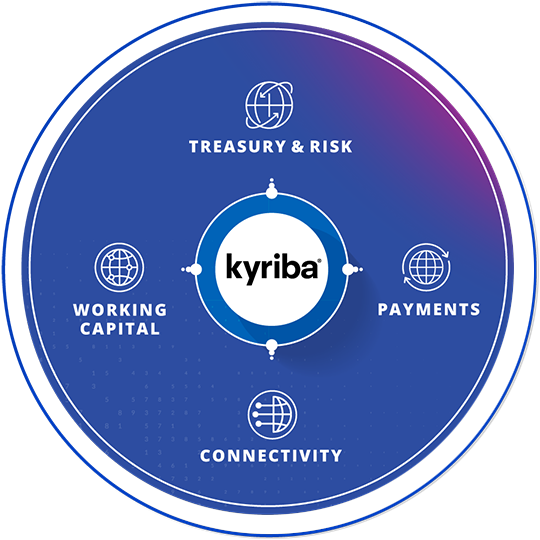

Enterprise Liquidity Management Platform

The Kyriba Enterprise Liquidity Management Platform connects systems, applications and data that strengthens an organization’s capability to improve financial performance. This unifies best-in-class treasury, risk management, payments and working capital solutions with external partners, including global banks, market data providers, trading platforms and third-party applications.

From Our Clients

"The main benefit I personally get from Kyriba is risk mitigation through much greater confidence in my treasury. I receive meaningful data to analyse, including automated standardised reports and accurate cash forecasts."

ANDREW NICHOLSON

CFO, GRAFF DIAMONDS

"Our goal was to create a solution oriented and agile treasury. We needed a secure, robust and scalable solution that integrated well with our systems, and we found that Kyriba was best aligned to support our needs."

VP Corporate Finance & Treasury,

Spotify

"I have worked with Kyriba about ten years now, and I’ve watched it grow and respond to its customers – truly valuing our feedback in a way that I’ve never seen another provider do."

TRISH FISHER

DIRECTOR, TREASURY OPERATIONS, WEWORK